Where You Are Now - A Macro Look

Part one of a multi part series looking at the world in 2022 and projecting an outlook.

I’m doing a brief overview of 2022 and kind of give an outlook of 2023. No formalities, lets begin.

Crypto

The 2 major cryptos are down on the year. Bitcoin -67% Ethereum -70%. Bitcoin was first advertised as a safe haven and that it would replace gold. But for now it seems to be correlated with global markets. This is probably because crypto investors skew young and younger people are looking to make money, not store wealth (they don’t have any). So for Bitcoin to become what It meant to be we probably have to wait a few years until the masses become more educated in it and for the current investors to get older and wealthier.

Lots of scams got exposed in the crypto industry but that’s to be expected, in a bear market Ponzi schemes fall like flies.

Would share more thoughts but crypto is BowTied Bull’s department.

United States

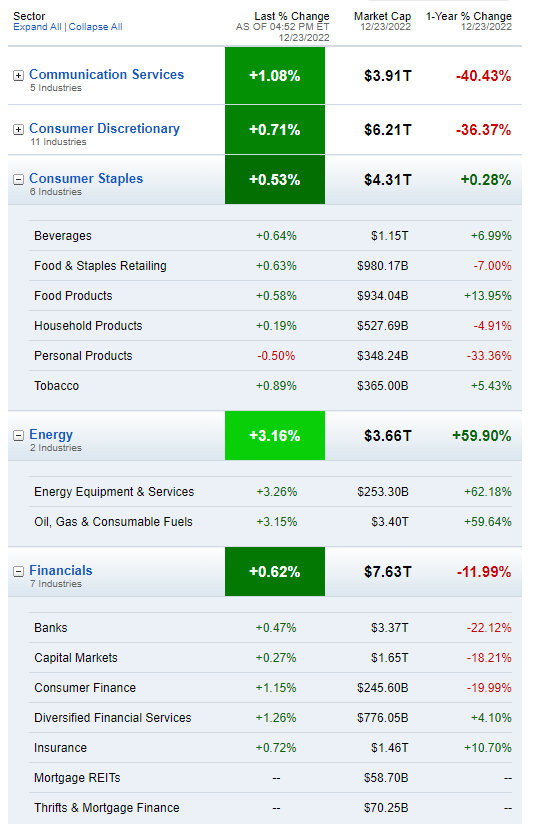

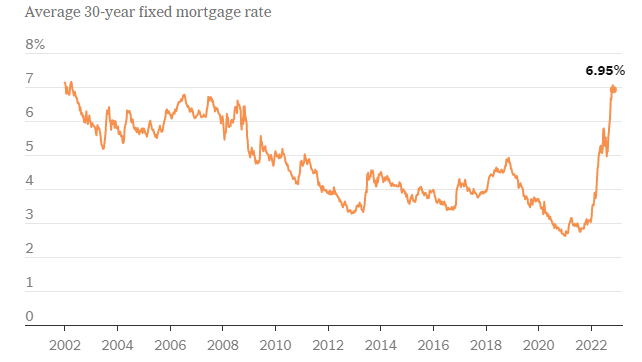

2022 was the year of the Federal Reserve “fighting inflation”. Though they never actually raised rates high enough to fully kill the inflation. “The current Federal Reserve interest rate, or federal funds rate, is 4.25% to 4.50% as of Dec. 14, 2022.” They claim inflation is 7.1% this December, they started the year off with 7%. Keep in mind they don’t calculate inflation like they used to. So in 2023 the “saga” with inflation will continue. In 2022 the US went into a recession by hitting 2 quarters of negative growth. The administration quickly ran interference and tried to soften the blow by saying “well technically it’s not a recession”. All sectors of the economy are down on the year except for Consumer Staples (food, drinks, home products etc.), Energy, and Utilities. Housing market is also down. Good news is that manufacturing seems to be making a comeback due to high import tariffs and supply chain issues. Got some Charts according to Fidelity, Freddie Mac, Also some old ones from November 2022 by S&P Global.

I expanded those who I thought were interesting.

Interestingly enough in 2022 Black Friday online sales hit the record high number of $9.12B an increase of 2.3%. But keep in mind numbers can be deceiving, people might just have been saving more to buy on black Friday because they have less money now and or inflation. Do your won research on that...

The US found an opportunity to bleed and test weapons against one of their “great power competitors” Russia, and they took it. They are currently supplying the Ukraine side of the war. US sent over/proposed $100B+ worth of aid to Ukraine over 10 months. The US has done this to all their past competitors including Russia’s predecessor the Soviet Union with Operation Cyclone and more, this should of came as no surprise to Russia.

China

China is a really funny country, it’s hard to get any concrete numbers from them that aren’t doctored. For China 2022 has been a year of ‘housing crisis’ and ‘Zero Covid’. The housing crisis began with the collapse of Evergrande in 2021. The damage continued into 2022 with the housing market completely plummeting.

China’s top trading partner the United States manufacturing orders are down 40%. A lot of US companies are looking to move their supply chains out of China. The US also introduced new export controls to restrict China’s ability to both purchase and manufacture high end semiconductor chips.

Zero COVID was an effort by China to completely eradicate covid-19, so with any minor sign of infections China went into full lockdown by region. Of course it’s China and they took a very heavy handed approach. People weren’t allow outside their homes even when starving. The government welded apartment building doors shut in some places. There was an incident where a fire broke out in an apartment building and people were stuck inside. It’s rumored that because of covid measures authorities could not get there in time and people died. Chinese citizens got pissed off and massive country wide protests broke out now known as the “White Paper Protests”. As always, the CCP tried to cover it up but failed this time. They tried to crack down but that also failed. The protests were made worst by the World Cup when Chinese citizens saw people attending and playing without any covid precautions.

In an unprecedented move the CCP folded to the public and reconsidered some covid measures. 2023 will be interesting for China because now the public knows they can pressure Xi to maybe get what they want. I don’t have any grand predictions here, it’ll be interesting to see how they deal with the declining manufacturing demand.

Japan

Japan? Why Japan? Japan is the 3rd biggest country in the world by GDP. But Japan is also a funny place because they’re highly intelligent and hard working but can’t seem to get their finances and birth rate right (they should pay me to change that lol). Japan’s debt is 229% of it’s GDP, they have to largest debt to GDP ratio is the world (Jesus). Japan has negative interest rates, in November their government intervened and spent $43B to support the falling Yen. Even though Japanese sectors are not as down bad as the US on the 1yr look, I don’t see this getting any better in 2023. To fix their debt, inflation and birth rate the Japanese will probably have to collapse their whole economy, allow more young immigrants in and start back from basics. Of course, easier said.

Another thing Japan has going for it is that it’s good friends with the US and has a trade agreement. That should be able to keep them from completely drowning.

Japan also increased their military spending by $7.3B for 2023, part of that is probably going to be spent on buying Tomahawk missiles from the US. Those missiles have a range of 1000 miles. If this deal goes through the Chinese would have lower their tone when they speak to the Japanese.

Update: “Bank of Japan makes unscheduled bond purchases for third straight day”.

As always, thanks for reading, Happy New Year!